|

Dear (Investor), |

|

The world is becoming more conscious of available resources, and we are all moving towards a sustainable future. With this in mind, in December 2021, we had taken the decision to fully allocate the money managed by DSP World Energy Fund to the Sustainable Green & Clean energy sectors. Therefore, DSP World Energy Fund is now investing up to 100% in BlackRock Global Funds (BGF) Sustainable Energy Fund. |

|

In case you haven’t read the note on this topic that we had uploaded on our website earlier, click below to download it now. |

|

Download the Note

|

|

Please note that we continue to have a strong belief in the long-term prospects of the sustainable green and clean energy space. If you are still interested in considering the traditional energy space, you can explore this fund. |

Regards,

Team DSP

#INVESTFORGOOD

|

| |

| Your last transaction with us did not involve a MFD/RIA and was classified as “DIRECT”. In case you make any investment decision after reading this email, please consult with your trusted MFD/RIA first |

| |

| |

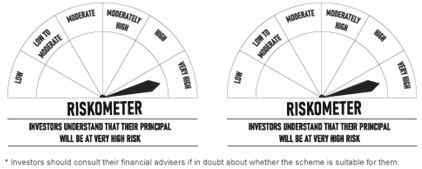

Scheme Riskometer |

Benchmark: 50% MSCI World Energy 30%

Buffer 10/40 Net Total Return + 50% MSCI

World (Net) - Net & Expressed in INR |

An open ended fund of fund scheme

investing in BlackRock Global

Funds – World Energy Fund (BGF –

WEF) and BlackRock Global Funds

– Sustainable Energy Fund

(BGF – SEF),

This Scheme is suitable for investors who

are seeking*

-

Long-term capital growth

- Investment in units of overseas funds

which invest primarily in equity and

equity related securities of companies in

the energy and alternative energy sectors

|

|

|

|

For performance of scheme in SEBI prescribed format, other schemes managed by Fund managers and other disclaimers of DSP World Energy Fund, click here. Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

|